Constant Factor AMM

Overview

Thruster's Classic AMM draws from the design principles of Uniswap v2. Similar to Uniswap, Thruster operates as a immutable, permissionless, decentralized platform, where pool holdings are exclusively controlled by the users who deposit them.

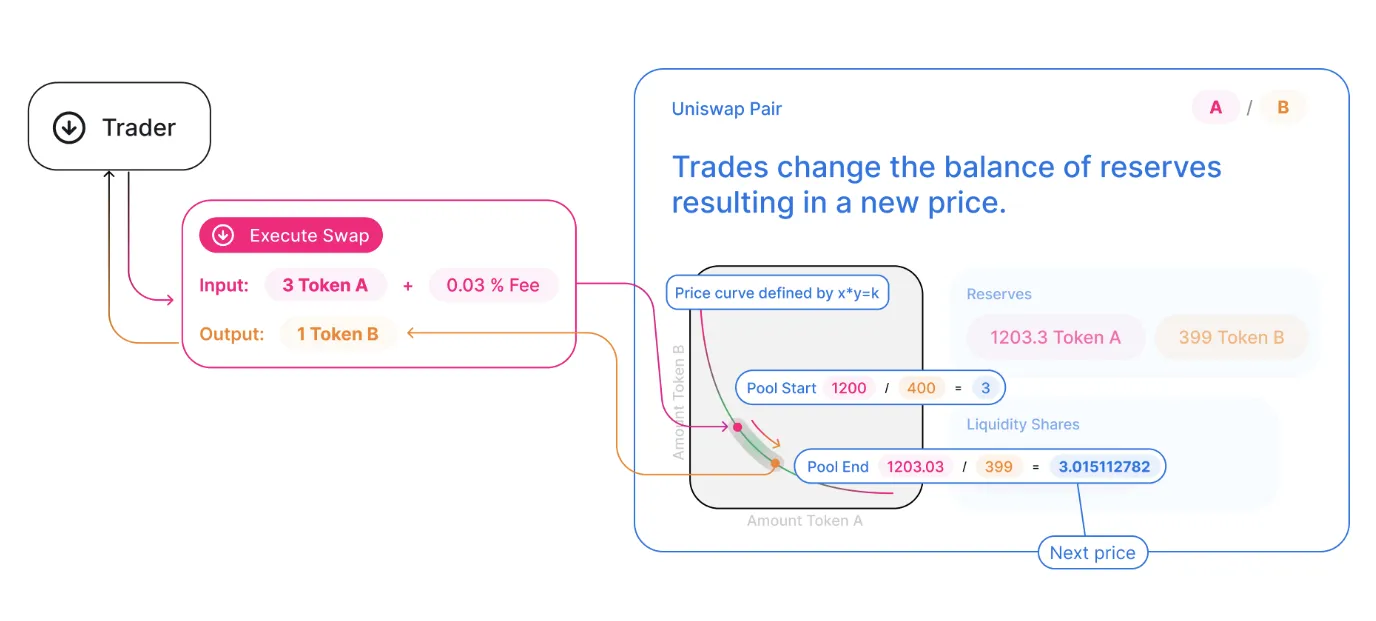

Uniswap pioneered an AMM based on the constant-product formula price curve best represented as: x(token1) ∗ y(token2) = k

This formula ensures that liquidity is provided for the pooled assets at any price point, no matter how large or small, even during large, sudden market moves.

This eliminates the need for active liquidity providers to provide bids or asks constantly for the market, as trades are directly routed via the passive pool vs a direct and active counterparty.

Low Barrier to Entry for Liquidity Providers

Uniswap v2's design allows a very low barrier to entry for any user to create and/or provide liquidity to a pool of choice, as long as they hold the requisite assets.

Users with assets of equivalent value on both sides of a pool can seamlessly add them to Thruster, receiving a fungible ERC-20 LP token representing their proportional exposure to the pool.

This LP is fee bearing as it generates fees and internal balances as swaps in the underlying pool take place. Users may incur impermanent loss if either asset of the pool significantly diverges from its initial deposit price.

Liquidity for Diverse Asset Pairs

This AMM design allows for liquidity for any fungible, non-rebasing ERC-20 asset, as long as liquidity has been added for those assets.

This means unique pool compositions can be created permissionlessly(such as ETH-BLAST, for instance) that would otherwise not exist on centralized exchanges. This flexibility in pool creation can allow for a broader range of pools (and thus increased fee capture for DEXes) as users can more easily represent their desired exposure to assets via a fee-bearing LP position vs. holding the assets independently.

Automated Fee Mechanism

To ensure liquidity providers are properly compensated for the risk they take when providing liquidity to a market, fees are automatically charged when a swap is made into the pool.

In practice, this increases the k constant of the x ∗ y = k equation, allowing LPs to withdraw their principal (accounting for price changes) along with accrued fees, if desired

What We're Changing

Thruster and its partners are making a number of changes and add-ons to the traditional design to accomplish our stated goal of acting as dynamic fair launch and liquidity infrastructure for Blast-native teams.

These include:

Adding fee tiers: All Uniswap v2 pools are stuck at a 0.3% swap fee, leading to a lack of flexibility for LPs seeking different fee structures based on the assets they provide to the exchange. Thruster will be adding fee tiers for pool creators to leverage when launching pools on Thruster, increasing the LP value proposition.

Incentives and Fees

Users get incentives for depositing into Thruster liquidity pools. These incentives include:

Blast Points

Blast Gold

Trading fees from swaps

Users are also eligible to earn Blast Gold from Thruster and partner protocols as well, making providing liquidity on Thruster one of the best incentive stacks to exist.

With regards to fees, a share of LP fees go toward a pool, with ZERO fees taken on Blast Points or Gold earned by the liquidity providers. Fees accrued once Thruster further decentralizes will be used as determined to bolster the utility of the Thruster protocol via expanded decentralized governance.

For more references about Thruster Classic, we recommend visiting the original Uniswap v1 and v2 documentation and visiting the multiple DeFi-centric resources online that reference Uniswap.

Last updated